Florida Seawall Foam Repair Using Terra-Lok™

October 2, 2023

Mastering the Basics: Calculating Spray Foam Needs for Your ProjectFor new spray foam contractors, understanding the science of insulation is the first step toward a successful and efficient project....

Spray foam insulation is an effective solution for keeping homes warm during the winter. This material serves as both insulation and an air barrier, effectively sealing wall, floor, and ceiling caviti...

Are you a spray foam contractor trying to decide between closed-cell spray foam and open-cell spray foam? Don't worry, we've got you covered! In this blog post, we'll explore the differences between t...

Spray foam insulation is a revolutionary solution that provides numerous benefits for both residential and commercial properties. It is a form of insulation that is applied as a liquid and expands to...

Are you considering venturing into the spray foam business? Are you curious about spray foam roofing and its potential benefits? In this guide, we will provide you with valuable insights into the worl...

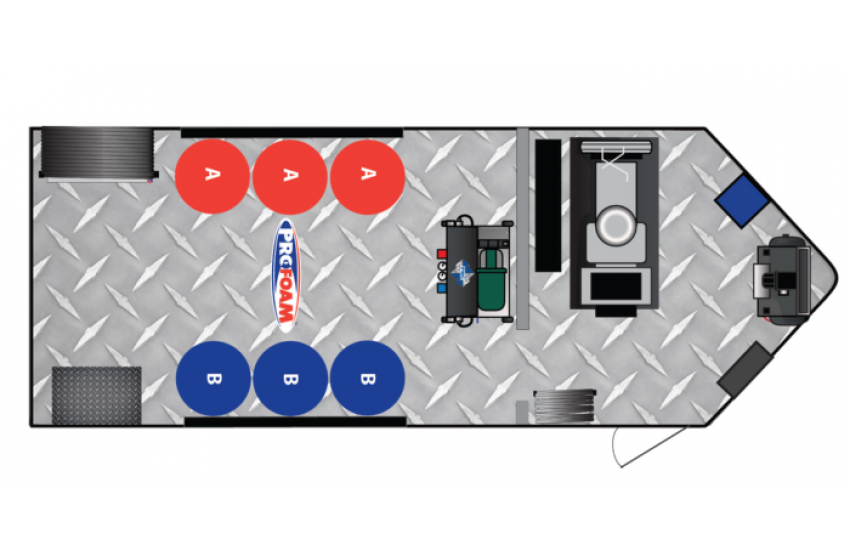

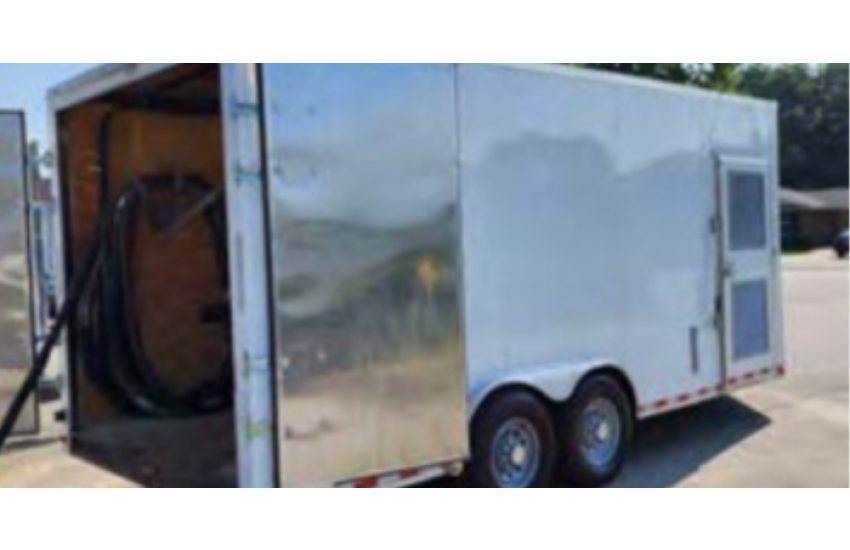

If you're a new spray foam contractor or considering entering the spray foam business, understanding the role of spray foam rigs is essential. Mobile spray foam rigs are incredibly valuable tools that...

Are you a spray foam contractor struggling to attract clients and close good deals? You're not alone. Marketing a spray foam business can be challenging, especially in a competitive market. However, w...

Spray foam rigs are essential equipment for anyone in the spray foam insulation business. They allow you to efficiently apply foam insulation to various surfaces, ensuring energy efficiency and comfor...

Located in Orlando, Florida, Slab Fix LLC undertook a significant project aimed at rectifying structural issues for Prodalim USA Inc., a well-established Juice Concentrate company headquartered i...

Florida Marine Builders faced the challenge of stabilizing and filling the seawall voids in Florida. They turned to the innovative seawall foam repair solution using the NCFI Terra-Lok™...

Keeping your spray foam equipment clean is essential for maintaining its performance and longevity. Proper cleaning ensures that your spray foam insulation machines operate efficiently to produce high...

Are you a spray foam contractor new to the business? If so, you may wonder what equipment you need to get started. Starting a new business comes with natural challenges, and one of the most important...

Spray foam insulation is an effective way to insulate buildings and homes, providing a barrier against air leakage and improving energy efficiency. When it comes to spray foam insulation application m...

Growing a spray foam insulation business is certainly a challenge many New York contractors can relate to. However, partnering with a company that offers spray foam supplies, equipment, accessories, t...

Are you an insulation contractor looking for a reliable spray foam supplier in Georgia? At Profoam, we cater to all your spray foam insulation needs. As a leading player in the industry, Profoam goes...

If you're interested in getting started in the spray foam business or if you're a current spray foam contractor eager to learn more, understanding how to operate an insulation removal vacuum will help...

Are you interested in starting a spray foam business? Or are you a current spray foam contractor looking to make your company expand? Your spray foam equipment is crucial to the quality job you delive...

Spray foam insulation is becoming highly popular as a type of insulation for attics due to its superior performance, sealing gaps efficiency, and preventing air leakage. In this article, we will explo...

Concrete leveling is a technique used to fix sagging or uneven concrete slabs, such as steps, porches, patios, sidewalks, and driveways. It involves filling voids beneath the concrete to restore its e...

Metal building insulation is a crucial aspect of maintaining a comfortable and energy-efficient environment within a property. Whether it's a commercial space, a warehouse, or an agricultural building...